Crypto Lending Platforms and Decentralized Finance News

Decentralized Finance News

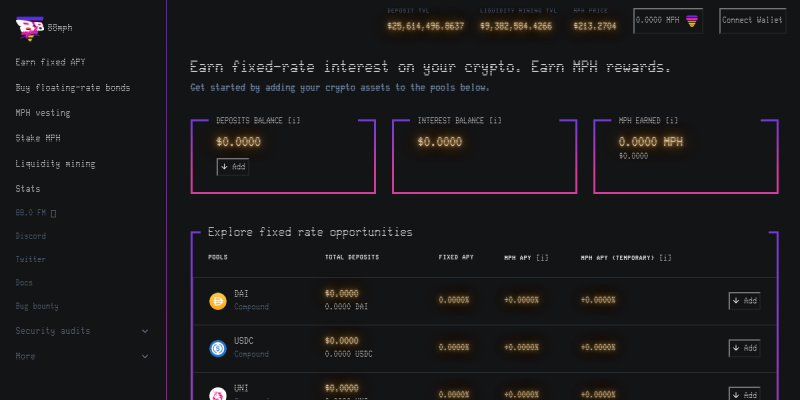

The popularity of cryptocurrencies has made it possible for decentralized finance projects to expand into many areas. One such example is crypto-backed lending, wherein investors invest in a borrower’s cryptocurrency, a stablecoin, in exchange for interest on the money. The concept of decentralized finance is appealing, but there are risks associated with it. Below, we’ll discuss a few of the dangers associated with using decentralized finance news as a means of finance.

One such project is the MakerDAO, which is an Ethereum-based lending platform that uses the Dai stablecoin linked to the US dollar as collateral. Founded in 2014 by Rune Christensen, MakerDAO has since grown to be one of the largest applications built on the Ethereum blockchain. This platform is the first serious DeFi application, with users placing up as much as $6 billion in collateral.

As the technology becomes more sophisticated, it will become a more reliable and secure source of finance for millions of people. It will also have major implications for the big data sector, which could lead to new ways to commodify data. Still, there is a long road ahead for DeFi and its public adoption. In the meantime, here are some important facts that you should know about DeFi and the potential benefits it brings.

Crypto Lending Platforms and Decentralized Finance News

MakerDAO is another crypto-backed lending platform. It uses the Dai stablecoin, linked to the US dollar. The platform was founded by Rune Christensen, and is the largest decentralized application on the Ethereum blockchain. It’s the first real DeFi application. Its users have already put up $6 billion in collateral. This is a good start, but more innovation is required.

DeFi also challenges the current centralized financial system by removing middlemen. By eliminating these middlemen, the industry will allow consumers to access credit without being regulated. The technology will also make it easier for people to access a diverse range of assets. And this is why cryptocurrency lending is the future of finance. The market for digital currencies is growing exponentially. A successful DeFi platform will allow users to borrow against their crypto assets.

ICOs and NFTs were the first two types of digital assets. ICOs provided startups and software developers a free way to raise capital, while NFTs allowed artists to monetize their works. The latter method is known as yield farming, and it is not for the faint of heart. Nevertheless, the technology has great potential to change the world of finance. While it is still in its infant stages, it is gaining momentum and potential for disruption.