Explaining the Concept of Due Diligence

Concept of Due Diligence

Whether you’re looking to buy or sell a company, a supplier or investor, you need to be able to do your due diligence. This means thoroughly investigating all aspects of a deal to make sure you’re getting what you’re paying for and that there are no hidden surprises.

The term ‘due diligence’ comes from the concept of reasonable care. This involves taking careful, well-informed steps that may even be a legal requirement to avoid bad outcomes in business or investment. This is often referred to in the context of M&A deals, but it can also be applied to real estate purchases, hiring employees, or anything that requires an element of risk mitigation.

In M&A terms, a typical example of due diligence is a seller conducting an investigation into the buyer to determine how they might be able to work together. This can involve examining things like culture fit, leadership styles, and the way people are paid. Performing due diligence can help avoid problems after a deal is completed by uncovering major assets, liabilities, and risks that were not uncovered before the sale was agreed upon.

Explaining the Concept of Due Diligence

Due Diligence can be a complex process and requires a lot of time, attention, and resources. This is why many companies hire M&A experts who have experience in this area. This can be beneficial for both sides because it can help ensure that all requirements are met and minimize the potential for unforeseen issues after a sale.

Explaining the concept of Due Diligence

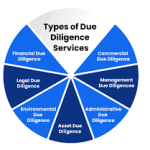

There are two main types of due diligence that businesses conduct. First, there is the basic due diligence that every company should undertake before entering into a contract or agreement with another company. This can include reading through contracts, reviewing compliance procedures, and verifying the facts about a business. It can also involve conducting interviews with key personnel to gain a better understanding of the company and its history.

The second type of due diligence is more in-depth and usually takes place when a business enters into a transaction with another company. This can include buying a whole entity, merging with or acquiring another company, or purchasing software or hardware. Enhanced due diligence is often more thorough than basic due diligence and can cover things like a detailed analysis of intellectual property rights, pending or potential lawsuits, debt obligations, long-term customer arrangements, warranties, compensation arrangements, employment contracts, distribution agreements, and so on.

Inquiring about the nature of Due Diligence

While conducting due diligence can be a tedious and time-consuming task, it is essential for anyone who wants to be successful in M&A or other types of transactions. This is because due diligence allows them to take control of the situation by ensuring they’re not entering into an agreement without full knowledge and awareness of all of the risks involved. This is why it’s important to consider M&A experts to assist in the process and help you avoid any pitfalls that may arise. Having a specialist by your side can save you a lot of headaches and stress.